However, this should not be the primary factor when determining which underlying instrument to trade. One way to avoid assignment risk is to trade stocks that don’t pay dividends or trade indexes that are European style and cannot be exercised early. There is also assignment risk if the short call goes in-the-money, particularly when it is close to expiration. The risk is highest if the stock is short put is in-the-money. The risk is most acute when a stock trades ex-dividend. While this doesn’t happen often, it can theoretically happen at any point during the trade. Some other risks associated with long call condors: ASSIGNMENT RISKĪnother risk of the trade is the risk of early assignment.

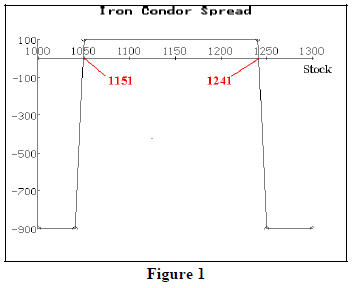

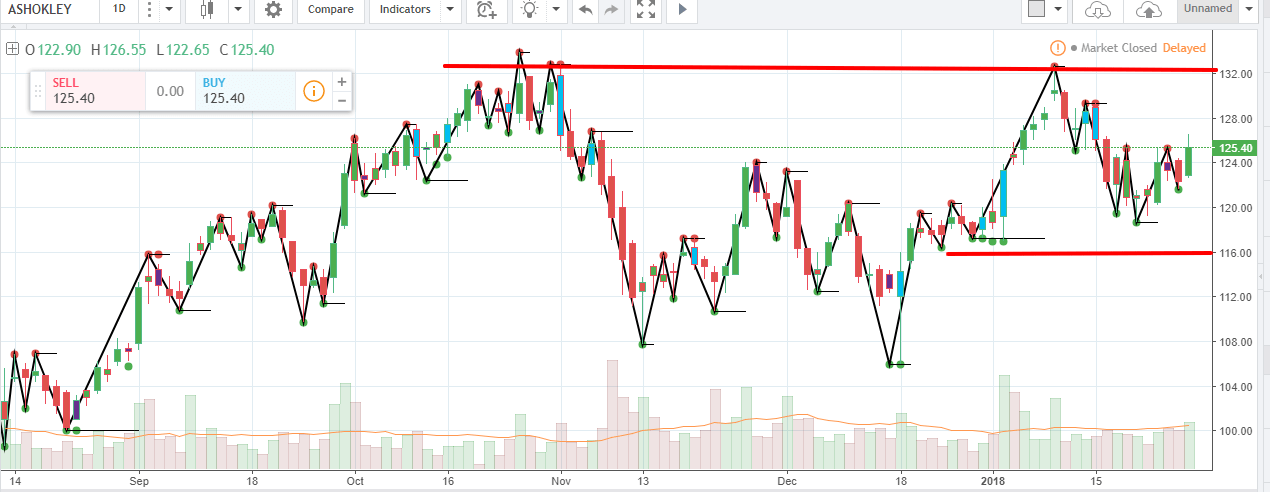

If the long call condor is structured as a bullish trade, we have a risk that the price of the underlying will fall, causing an unrealized loss or a realized loss if we close the trade. When the stock is outside the profit zone, the trade will have negative theta and lose money through time decay. When the stock is trading in the profit zone, theta will be positive, meaning the trade will make money each day through time decay. Like volatility, time decay will vary depending on where the stock is trading. The trade will have negative Vega when the stock price is within the profit zone and positive Vega when the stock price is outside the profit zone. You can read more about implied volatility and Vega in detail here. If the position has positive Vega, it will benefit from rising volatility. If a position has negative Vega overall, it will benefit from falling volatility. Vega is the greek that measures a position’s exposure to changes in implied volatility. Traders will exercise the call to take ownership of the shares before the ex-date and receive the dividend.įor this reason, traders need to be careful of early assignment if the stock is above the first short call and it is close to expiration or an ex-dividend date. Usually, early assignment only occurs on call options when there is an upcoming dividend payment. You can mitigate this risk by trading Index options, but they are more expensive. There is always a risk of early assignment when having a short option position in an individual stock or ETF. This example on AAPL has a profit zone between 172.50 and 195.50. The trade has positive delta, as seen from the T+0 line and the greeks. Placing the long call condor with a directional bias gives it a favorable risk to reward ratio. Let’s look at another real example so we can also see the T+0 line. Looking at the payoff diagram above, we see that all four call options are out-of-the-money. Upper breakeven = 50 + 2 = 52 Payoff Diagram The upper breakeven can be calculated by taking the upper short strike and adding the premium received: The lower breakeven price can be calculated by taking the lower short strike and subtracting the premium received. Placing the strikes further closer together results in a higher premium received and a narrower profit zone. When this occurs, the lower long call and the lower short call will be in-the-money and subject to assignment risk, so please be aware of this! The maximum gain occurs when the underlying stock price closes between the short calls on the expiration date. The maximum gain is limited to the width of the strikes less the debit paid. In the above example, if we paid $300 for the long call condor, that is the maximum potential loss. To calculate the maximum loss, is equal to the debit paid. The maximum loss will occur when the stock finishes below the lowest call or above the highest call on the expiration date. You can also think of this as a combination of a bull call spread (debit spread) and a bear call spread (credit spread).

To execute the strategy, the trader would place the following trade as an example on a stock trading at $40.

Typically traders will use a long call condor as a bullish trade and place all four legs out-of-the-money. This trade can be entered as a neutral trade, but that would carry assignment risk with one of the short calls being in-the-money. Many of you will be familiar with regular iron condors, which use both puts and calls. Today, we are looking at the long call condor strategy.

0 kommentar(er)

0 kommentar(er)